What to do next… and why it is important to ACT NOW

When you submit an enquiry online, you may receive an email from the Trade Desk with a Provisional RPA Offer attached. If the terms of the offer are acceptable to you, it is IMPORTANT that you confirm you wish to PROCEED (as instructed in the email used to send the RPA Offer) without delay.

The Exchange is a fast moving, liquid market that operates on a ‘first come, first served’ basis. In accordance with the Allocation Policy, Provisional RPA Offers automatically EXPIRE, after 72 HOURS from time of issue (and must be re-issued). Funds allocated to unconfirmed RPA Offers are re-allocated to other Originators (and may not be re-issued for some time).

RPA Offer Headings

All RPA Offers are issued in writing and will specify the terms of trade and charges that may be applied to the Originator account. These are explained as follows:

Facility Overview

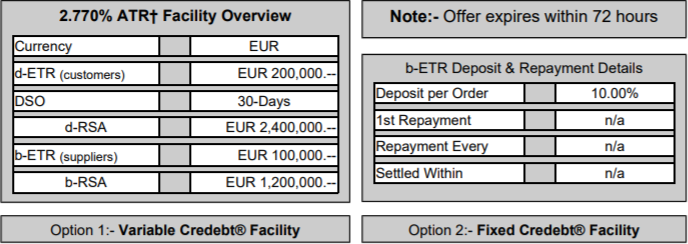

Facility Overview heading indicates the Annual Target Rate [ATR]† for the RPA Offer

Currency

This indicates the primary purchasing currency, e.g. Euro, Pounds Sterling or US Dollar

d-ETR (customers)

An Exchange Traded Receivable [ETR] is and invoice that is purchased by the Exchange. A d-ETR is a debtor or customer invoice. This field tells you what is the estimated value of d-ETR, or customer invoices, you plan to sell to the Exchange every DSO

DSO

Day Sales Outstanding [DSO] is the average number of days your customers/debtors take to pay your invoices

d-RSA

If you divide the number of days in a Year (based on 360 days) by the DSO and multiply this by the d-ETR value, you can calculate the debtor Revolving Sale Agreement [d-RSA] amount that the Exchange will purchase in 1 Year. As in this example: 360 / 60 = 6 x 1,000,000 = 6,000,000

b-ETR

An Exchange Traded Receivable [ETR] is and invoice that is purchased by the Exchange. b-ETR is an optional service that purchases creditor/supplier invoices. Payments to suppliers/creditors are settled by trading d-ETR in back-to-back transactions. This field tells you what is the estimated value of b-ETR, or supplier invoices, the Exchange will pay ‘on demand’ every DSO

b-RSA

This is the total amount of the back-to-back Revolving Sale Agreement [b-RSA] that the Exchange will pay on your behalf in 1 Year

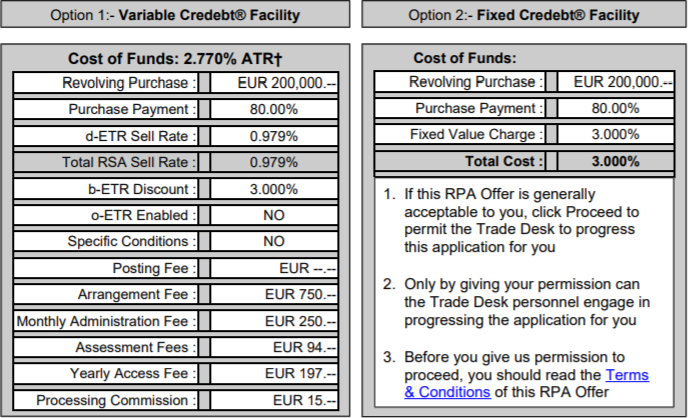

Option 1:- Variable Credebt® Facility

The Variable Credebt® Facility calculates the cost of every transaction depending on the number of days each ETR takes to get settled, or paid in full.

Option 2:- Fixed Credebt® Facility

The Fixed Credebt® Facility applies a fixed fee to the Face Value of the ETR/invoice, regardless of how long the ETR takes to get settled, or paid in full.

Cost of Funds & ATR

The cost of funds is calculated based on the Annual Target Rate [ATR]. The ATR is calculated the same way as Annual Percentage Rate [APR], subject to the correct trading balance between d-ETR and b-ETR invoices sold to and bought by the Exchange. All b-ETR should be traded at a discount to the Face Value of no less than 3.000% per 30-days. The Exchange automatically retains its required 50.00% share of this discount (whether present or not) and applies a minimum 1.250% premium to all supplier payments. To achieve the ATR indicated on the RPA, the 3.000% discount per 30-days must be used

Revolving Purchase

The Revolving ETR Sale Agreement [RSA] is a ‘best estimate’ of the d-ETR the Originator expects to utilise at any moment in time

Purchase Payment

The Purchase Payment amount that is paid and transferred to the Originator against each Traded ETR on the Exchange. Note:- Purchase Payments made to Credebt Money® accounts may be held in another Credebt Money® account other than the one designated to the specific Originator

d-Sell Rate

Under Option 1 this is the Variable Credebt® Facility Discount applied to each Traded ETR

Fixed Value Charge

Under Option 2 this is the Fixed Credebt® Facility Discount applied to each Traded ETR

Total RSA Sell Rate

Under Option 1 this is the total variable credebt® facility Revolving Sale Agreement [RSA] sell rate on each trade

Total Cost

Under Option 2 this is the total fixed credebt® facility Revolving Sale Agreement [RSA] cost on each trade

b-ETR Discount

The expected discount your suppliers/creditors should give you for paying them early, or on demand, using the b-ETR supplier payment facility

b-ETR Settlement

Credebt® b-ETR reconciliation expected to occur within 48 hours after cleared funds received. Engagement with Originator should occur 72 hours after settlement and available funds transferred 92 hours after payment was received.

o-ETR Enabled

Supplier or order finance is available to all Originators once they have been approved by Trade Desk & Treasury [TD&T]. It is not immediately available on opening your account unless it is approved in advance. If it is, this field will display ‘YES’

Specific Conditions

If there are any special or specific conditions of trading with the Exchange, this field will indicate ‘Documented’. If so, the specific conditions will be in the same email you received with the Provisional RPA Offer

Posting Fee

The Posting Fee charged for every single invoice that is posted to the Trade Floor prior to becoming a Traded ETR

LDC Premium

If an LDC Premium is specifically indicated on the RPA, this is a Loss & Default Control commission percentage charge based on the Face Value of every single invoice posted to the Trade Floor prior to becoming a Traded ETR. LDC Premium is used when trades are considered to be high-risk. It is neither an optional charge and nor is it negotiable

Arrangement Fee

Once-off charge for arranging the Originator Membership and/or for providing additional services to enable the account. This may, or may not, include Application or Commitment Fees. All third-party fees, e.g. legal fees, assessment and/or surveyor fees, etc. are for the Originator’s account and are not part of the Application Fee.

Monthly Administration Fee

The Originator’s monthly Membership Fee, regardless of trading volume or value, until Membership is cancelled. This includes hourly fees for account management and administration

Assessment Fee

EUR 11.75 charge for checking each debtor’s credit rating (whether the debtor is approved or not) prior to trading any debtor

Yearly Access Fee

Annual charge for the Digi-Access™ two factor authentication digital certificate necessary to access the Exchange

Processing Commission

The Processing Commission is a payment charge deducted from each and every payment transferred to the Originator, regardless of the value

Trade Commission

Unless specifically indicated on the RPA document, the Trade Commission is a charge deducted from each and every Traded ETR and Settled ETR, regardless of the value

Credebt Exchange® Document

In accordance with the Credebt Exchange® Master Agreement, and as defined therein, this is a Credebt Exchange® Document. All Originator and Agent Members of the Exchange are bound by all of the provisions contained in this Document. THIS IS AN IMPORTANT DOCUMENT AND IT SHOULD BE READ CAREFULLY TO ENSURE COMPLETE UNDERSTANDING PRIOR TO ACCEPTING ANY RPA OFFER. If you have any queries in relation to this Document, the online form is the most efficient way to contact us, or you can email us with any queries.

Provisional RPA Offer

Provisional RPA Offer Policy

All Provisional RPA Offers are issued as PDF attachments to an email. If the PDF document contains the text: ‘Documented’ opposite the ‘Specific Conditions’ label in the Provisional RPA Offer, the Originator is accepting these Specific Conditions that are a formal part of the RPA Offer confirmation.

Allocation

Allocation Policy

Credebt Exchange® manages an orderly market using this Allocation Policy to govern the equitable and efficient use of funds on the Exchange. As specified in the RPA Offer, the Revolving Purchase is confirmed by the Originator and accordingly Credebt® allocates the funds. To avoid Over Allocation, all funds allocated to all Originators must be substantially utilised (i.e. at least 75% used) within 30-days from the date of allocation.

The Revolving Purchase value specified in the RPA Offer is the Allocation Limit and should not be exceeded at any time. If an Originator requires a limit increase, Credebt Exchange® may issue an updated Formal RSA Offer with a new Allocation Limit. Exceeding the current Formal RPA Offer Allocation Limit is a Prohibited Practice (as defined in the Credebt Exchange® Master Agreement) and may result in funds being unavailable, or restricted.

Over Allocation is a Prohibited Practice, as defined in the Credebt Exchange® Master Agreement, may cause a disorderly market and is detrimental to the best interests of the Exchange and its Members. Credebt Exchange®, in its sole discretion, may cancel, or replace with an alternative RPA Offer, any confirmed RPA Offer, impose limitations, charges, conditions, or restrictions upon the Originator, or terminate the Originator Membership, where Over Allocation occurs.

Payment

Payment Policy

(abbreviated)

The Credebt® Payments Policy uses the trading industry standard of Tomorrow or the Next Day [TomNext]. Unless Same-Day payment (at a cost of EUR) is specifically requested by the Originator, all Purchase Price and Reserve payments are TomNext. Please allow at least 72 hours for all TomNext payments to be processed before reporting a payment as ‘missing’. Some banks do not process payments as efficiently as others. As indicated on the Provisional RPA Offer, or the Formal RPA Offer if provided and whichever is the most current, a Trade Commission charge is automatically deducted from every payment transfer to an Originator, regardless of value.

Repayment

Repayment Policy

The Credebt Exchange® Repayments Policy for [a-ETR] Asset Finance for Ships typically uses fixed repayment amounts, each period (typically a month), for the total duration of the Lease Finance, e.g. 3-Years. Depending on the asset, the market and the repayment capacity from the asset, a Strong Market Schedule [SMS] may be required by the Exchange. An SMS will not alter the total interest applied to the finance but it will require faster repayment of the principal.

SMS-1

A Strong Market Schedule 1 [SMS-1] will require a higher percentage of the principal repaid in Year-1, e.g. 70.00%. The repayment of the balance will be spread equally over the remaining Asset Finance period. The overall interest for the total life of the Asset Finance remains unaffected.

SMS-2

A Strong Market Schedule 2 [SMS-2] will require a higher percentage of the principal repaid in the first 2 Years, e.g. 70.00%. The repayment of the balance will be spread equally over the remaining Asset Finance period. The overall interest for the total life of the Asset Finance remains unaffected.

SMS-3

A Strong Market Schedule 3 [SMS-3] can be combined with an SMS-1 or SMS-2 whereby the asset ownership is shared equally on a 50:50 basis between the disponent owner and Credebt.

Reserve

Reserve Policy

The Reserve is paid to an Originator on reconciled trades only (referred to as R-Trades). Payment of any Reserve to an Originator is subject to the Overdue Policy and, in accordance with the Credit Note Policy, the R-Trade Reserve amount is paid after deducting the value of the credit note(s).

With exception of Outright ETR trades, allocated payments (referred to as A-Trades) continue to deduct the Sell Rate (as indicated on the Provisional RPA Offer Notice, or the Formal RPA Offer if provided and whichever is the most current) divided by 30 to calculate a single day, as illustrated in the Cash Balance Policy DSO calculation, for each day it remains an A-Trade. Once the A-Trade is reconciled/converted to an R-Trade, the daily calculation of the Sell Rate ceases to use the current date and uses the Settlement Date. In the case of Outright ETR, the Sell Rate is fixed, regardless of when it is Settled. As an R-Trade, the Sell Rate is fixed and payable in accordance with this policy.

In accordance with the Credebt Exchange® Master Agreement, the Originator’s entitlement to any Reserve is at the discretion of Credebt Exchange®. All Reserve payments must be agreed on, or before, the Maximum Maturity Date. Reserve payments not agreed prior to the Maximum Maturity Date, automatically expire and no Reserve payment is due.

High-Risk Debtors are debtors with any bad credit rating from a Rating Agency. Traded ETR from High-Risk Debtors, will affect all Reserve payments to the Originator. The Face Value of all Traded ETR from all High-Risk Debtors that are not Settled are deducted from any Reserve payment. Originators trade in High-Risk Debtor ETR at their own risk.

High-Risk ETR are Traded ETR purchased close to, or after, the Maximum Maturity Date. High-Risk ETR, will affect all Reserve payments to the Originator. The Face Value of all High-Risk ETR that are not Settled are deducted from any Reserve payment. Originators trade in High-Risk ETR at their own risk.

For any Originator that is a debtor of another Originator, any amount payable by the debtor to the Originator may be set-off by Credebt Exchange® against any amount payable by the Exchange to the other Originator.

Reserve payments that are agreed prior to the Maximum Maturity Date, are only made when the total amount outstanding is less than the confirmed Revolving Sale Agreement [RSA]. For example, if the RSA displayed on the Exchange Trade Centre | Statement Summary shows EUR 400,000 and GBP 600,000 and the total amount outstanding on Traded ETR in either currency is greater than EUR 400,000 or GBP 600,000 then no Reserve payment will be made until the total amount outstanding in both currencies is less than the RSA values displayed.

Reserve payments to Originator’s that opt to have Credebt Exchange® undertake a Buy-Out (i.e. purchase all outstanding invoices and fees from an IDF provider) are only made when the total amount outstanding is less than the Buy-Out value. For example, if the Buy-Out cost was EUR 500,000 then Reserve payments commence after the initial Buy-Out cost of EUR 500,000 is paid in full.

Cash Balance

Cash Balance Policy

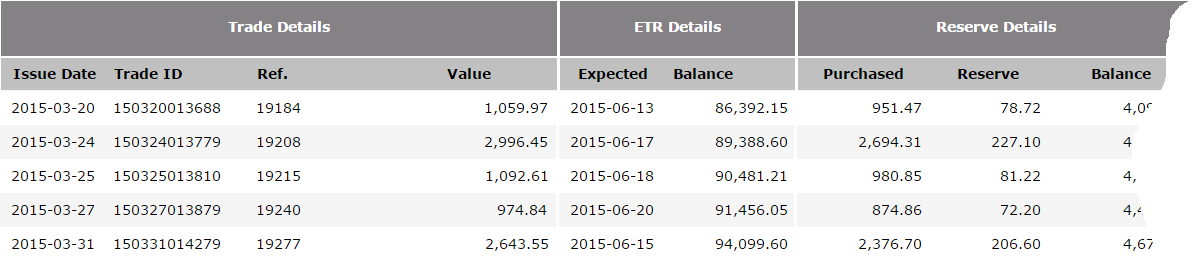

Reconciled receipts occur automatically when a payment is received that has the exact same value as the Face Value of a single Traded ETR. With exception of Outright ETR trades, the Reserve paid to the Originator is calculated based on the time it takes for a Traded ETR to be Settled (commonly referred to as Day Sales Outstanding [DSO] in accounting terminology). In the case of Outright ETR, the Sell Rate is fixed, regardless of when it is Settled. For automatically reconciled receipts, determining the DSO is simply a case of subtracting the Purchase Date from the Payment Date. As explained in the following paragraphs, determining the DSO for payments against multiple ETR is not straightforward.

Frequently, debtor payments do not match the exact Face Value of Traded ETR. Regularly, payments are intended for multiple Traded ETR and even multiple debtors. It is neither practical nor plausible to expect Originators to manually reconcile their debtor balances on a regular basis and/or at a specific time, or day. In the absence of perfectly reconciled debtor balances, it is important that the Reserve is paid efficiently. Ensuring that the Reserve on every Traded ETR (whether reconciled or not) is paid at the earliest possible time is the governed by the Credebt® Cash Balance Policy.

The Credebt® Cash Balance Policy governs the system that calculates the Reserve based on the commonly accepted and recognised accounting principal of First In, First Out [FIFO]. FIFO is typically used to calculate the value of inventory at the end of any specific period and, when adapted for Traded ETR, the FIFO method means that Traded ETR purchased first are Settled/paid first and newer ETR remain unpaid.

With exception of Outright ETR trades (because the Sell Rate is fixed, regardless of when it is Settled), using the FIFO method, the DSO is calculated using the oldest Purchase Date for multiple Traded ETR assigned to a single debtor payment. Similarly, an Originator remitting a single payment against multiple ETR, payable by multiple debtors, uses the same method. TARGET2 specifies the number of days in a month and the Reserve for all ETR is consistently calculated as follows:

Reserve = Face Value – (Face Value x RSA x DSO)/30 – Purchase Price*

* For every day that the ETR remains unpaid it is this formula that is used to calculate the reduced Reserve, less any processing commission.

With the Credebt® Cash Balance Policy ensuring that the oldest Traded ETR are assigned to the oldest payments, the oldest ETR are automatically regarded as Settled and newer Traded ETR are assigned to ending balances. The actual flow of Traded ETR and Settled ETR may not exactly match the FIFO pattern but the balance outstanding against unpaid ETR will always be correct. The following example illustrates the FIFO method used in the Credebt® Cash Balance Policy:

As an example, a debtor with three Traded ETR due to be Settled in 90-Days on different Expected Dates, makes a single payment against all three ETR, two of which are paid before their Expected Date. The Settlement Date is the date the payment is identified in the Account Bank. Using the FIFO method for the Purchase Date, the Exchange must use the oldest ETR. This means that in practical terms that although the payment on two of the ETR was before the Expected Date, the Exchange sets the Purchase Date for all three as the same date. Using the Purchase Date set by the Exchange, this is subtracted from the Settlement Date to give the DSO. The Reserve is then calculated based on this DSO. In this example, in real terms it is possible that two of the ETR that were paid early, were calculated as being outstanding for longer than they actually were. If there is an over/under payment to the Originator, this can be adjusted when the Originator submits an agreed reconciliation for the account.

Credit Note

Credit Note Policy

The Credebt® Credit Notes Policy requires that all rebates, credits, off-sets, credit notes or any deduction that affects the Face Value of a Traded ETR, regardless of how the deduction was arrived at, is documented in an official Credit Note by the Originator and issued to Credebt®. Credit Notes are automatically deducted from the Originator Reserve balance and does not affect the Face Value of Traded ETR. IMPORTANT: where the total value of Credit Notes on an Originator account exceeds 1.00% of the total value of traded ETR, for each 1.00% the Purchase Price paid will be 5.00% less than the Purchase Price stated on the RPA Offer.

Overdue

Overdue Policy

In accordance with the Reserve Policy, payment of the Reserve to an Originator is made on R-Trades only. In addition to the Reserve Policy on R-Trades, payment of the Reserve to an Originator will always be less than the total balance of all Overdue Now balances. Overdue Now and Reserve balances are clearly displayed at the bottom of the Exchange Trade Centre | Statement Summary. For example, if on the Statement Summary the R-Trades Reserve balance is EUR 10,000 but the Overdue Now balance is also EUR 10,000 then no Reserve is due. If however the Overdue Now balance was EUR 7,000 then EUR 3,000 would be due and paid. It is therefore VERY IMPORTANT that the Overdue Now balance is maintained at 0.00 at all times.

Repurchase

Repurchase Policy Event

An ETR Repurchase may be used whenever a Traded ETR must be refunded. The Trade Desk ETR Off-Set notice will advise the Originator that an ETR must be refunded. The ETR Off-Set occurs in priority to an ETR Repurchase. Within 72-hours of an ETR Off-Set notice being issued, the Originator must send an ETR of the same value as the ETR that must be refunded. In the absence of a suitable ETR of the same value, in accordance with the Credebt Exchange® Master Agreement, an ETR Repurchase event will occur.

For Outright ETR trades, the Repurchase Price is the Face Value plus the Credebt® commission. For all other ETR, the Repurchase Price is the Purchase Price plus the RSA charged on a 1/30 basis.

Repurchase Price = Purchase Price + (RSA x DSO)/30 *

* It is this formula that is used to calculate the Repurchase Price, less any processing commission.

Foreign Exchange

Fx Policy

Credebt® does not offer any Foreign Exchange [Fx] services. Credebt® buys foreign currencies on an ‘as needed’ basis. When an Originator sells to the Exchange, an ETR gets the Credebt® Fx Rate on the day. This gives the Originator full value of the Purchase Price on the day they sell.

Originators that want to hedge foreign exchange exposure should seek the services of an Fx service provider. The Credebt® Fx Policy does not permit any foreign exchange exposure to the Exchange or to Investors. Originators that Sell ETR in EUR, GBP or USD receive all payments in EUR unless they specify a bank account that will accept other currencies, e.g. GBP or USD by using the Add new Currency menu item from the Exchange Trade Centre. Any Originator that has not specified a bank account for receiving payments in another currency other than EUR will receive the Purchase Price of all ETR, with a Face Value in GBP or USD, in EUR using the Credebt® Fx Rate on the date the ETR is Traded.

When the Reserve is due and payable, payment will be at the same Fx rate as the Purchase Price or the market Fx rate, whichever is the greater. If the market Fx rate on the Reserve payment date is less, the lower amount will be paid. At the sole discretion of the Exchange, the amount payable will include deductions for any reduction in the value of the Purchase Payment made by the Exchange due to Fx rate changes.

A Credit Note or Specific Deduction (that behaves like a credit note) will also affect the value of the Reserve payment. A Credit Note, Specific Deduction or Fx loss that results in a Margin Call will be for the value of that loss and will result in a reduction of the Reserves and other funds, including reductions on the Purchase Price, due to the Originator. The value of any reduction will be equal to the Fx loss specified on each of the referenced trades.

Closing an Account

Account Closing Policy

An Originator may request to close their account at any time. Credebt®, in its sole discretion, will accept or reject such requests based on many factors. Account closure requests should be submitted in writing to the Exchange. If the closure is during the Initial Term, Exit Fees may apply. Accepted account closures take 28 days from receipt of the written closure request until the account is closed and all funds are dispensed. The Exchange will endeavour to close the account sooner but all Members should allow 28 days.

Exit Fees

Exit Fee Policy

The use of the Exchange and the Exchange Services provided to a Member requires a minimum of 1-Year of uninterrupted trading (“Initial Term”). Unless either Party gives written notice to the other Party, not later than 90 days before the end of the Initial Term, a further term of 1-Year automatically commences (“Extended Term”). Termination by the Member during the Initial Term, or without notice 90 days before the end of the Term results in Exit Fee charges as determined by Credebt®, in its sole discretion. A Member account closure can only occur if the balance of all accounts have been settled to zero. In the event of any dispute, or any accounting issues, or discrepancies the account will remain open until all dispute and discrepancy matters are resolved to the satisfaction of Credebt®. Amounts owing to or owing from Credebt® must be settled in full and agreed in writing by the Trade Desk prior to account closure and as determined by Credebt®, in its sole discretion.

Exit Commissions will apply to the sale of an asset if it is sold prior to the end of term period for a value greater than its original value. The Exit Commission will be 50.00% of the profit on the sale value, plus any Credebt® legal and third-party costs.For the sale to occur, repayments must be up to date or will be settled from the sale price along with any legal and third-party fees.

Inside Deal

Inside Deal Policy

The use of the Exchange and the Exchange Services provided to a Member is based on trust, openness and transparency. It is a principal aim of the Exchange that all Members prosper. An ‘inside deal’ is a feature of trading in the form of seller, buyer or volume discounts; arrangement, agent or broker fees; preferential discount rates; etc. that financially benefit a Member. Any and all inside deal income, howsoever generated by a Member, must be fully disclosed in advance of trading. Otherwise it will be regarded as undisclosed. Another form of inside dealing is where an Originator engineers, or tries to engineer, a transaction to ensure direct, or first payment position ahead of the Exchange. This is a form of funds diversion for the benefit of the Originator at the expense of the Exchange. The Exchange does not support any form of undisclosed inside dealing. Undisclosed inside dealing is any undisclosed financial gain, or attempted financial gain, by a Member or any third-party such as an agent, partner or adviser, or an employee, agent, contractor or other associated entity of the Credebt® Group of companies. Undisclosed inside dealing is a breach of trust and is a Member Default event under the Master Agreement.

An undisclosed inside deal, as determined by Credebt®, in its sole discretion, is a Member Default and will result in immediate Termination of Membership of the Exchange. The immediate termination of a Member will result in all undisclosed amounts becoming immediately due and payable to the Exchange. In addition, all outstanding liabilities of the Member become immediately due and payable to the Exchange. Also, all amounts due from the Exchange to the Member are automatically and immediately forfeited by the Member, regardless of the circumstances of the undisclosed inside deal. It is the Member’s responsibility, in its sole discretion, to inform the Exchange of any and all inside deals.

Collection Agent

Appointment as Agent

For the purpose of facilitating the collection and receipt of each Traded ETR, each Originator shall act as collection agent for the Investor and in such capacity shall at its own expense, unless otherwise provided for in this Agreement, adhere to the ETR Collections Policy and collect (and take all such action or legal or other proceedings to enforce payment as the Investor may require) all or any money owing in respect of each Traded ETR and ensure that the said monies collected by it are paid immediately into the relevant Member Account or to such other bank account as the Document Agent may advise in writing, from time to time, without any deduction whatsoever so that the same or the appropriate part thereof can be applied in accordance with the provisions of this Agreement or if instructed to do so by the Investor shall pay all such money as is actually received and without any deduction whatsoever to any specified agent from time to time nominated by the Investor.

The Investor, or the Document Agent on behalf of an Investor, may at any time terminate an Originator’s appointment as collection agent under Section 6.13 of the Credebt Exchange® Master Agreement and by itself, the Servicer (acting on behalf of the Investor) or any other appointed Person, collect each Traded ETR from the debtors, in which case the Originator undertakes to the Investor that they will not interfere with the collection by the Investor of any money owing in respect of each Traded ETR or request any debtor to make payment in respect of any Traded ETR otherwise than to the Investor or as the Investor from time to time may direct and will not otherwise attempt to divert any money owing in respect of each Receivables Property from the Investor and that the Originators will not receive or collect or attempt to receive or collect from the debtors any such monies or any part of them to the intent that the Investor shall have the sole right of collecting and enforcing payment of each Traded ETR and the Originators shall upon request co-operate and afford the Investor all such assistance as the Investor may require to procure such collection and enforcement. The Investor undertakes not to terminate an Originator’s appointment as collection agent under Section 6.13 of the Credebt Exchange® Master Agreement except where it has a reasonable belief that it may be detrimental to the Investor not to do so.

Audit Requirements

IMPORTANT: audit requirements have only ever been requested by TD&T if there were serious issues relating to the management or use of the credebt® facility. In this event only and in the absence of providing TD&T with access to an approved online accounting system like Xero, an Originator may be required to provide information on a regular basis as indicated below. For the avoidance of doubt, this is an unusual request and is subject to specific events that gives TD&T cause for concern.

Monthly Requirement

The information that may be requested could include: Opening Aged debtor balance per the Originator’s accounting system; invoices traded in the period; Credit Notes uploaded in the period; and payments received by debtor Exchange or received by the Originator and passed to Credebt® in the period. In addition, an Detailed Aged debtor Analysis, Detailed Aged Creditor Analysis along with Originator Bank Statements are also required.

Quarterly Requirement

Furthermore, the additional information that may be required within 10 calendar days after each quarter end could include: Month end aged debtor reports (summary version); Monthly sales ledger daybooks (Invoices, Credit Notes, debtor receipts, Discounts and any adjustments) since commencement of trading; Copy invoices and proof of delivery/satisfaction notes/signed timesheets/paper trail etc; Copy invoices and proof of delivery/satisfaction notes/signed timesheets/paper trail etc; Copy credit notes and back up information; Cash allocation reports and remittance advices; Latest Management Accounts (profit and loss, balance sheet and nominal ledger trial balance); Latest Credebt® Monthly Reconciliation of Aged Debtors; Monthly aged creditor reports (summary of last 3 months); Bank statements for all accounts in the company name from commencement of trading; Cashbook (if applicable); PAYE, VAT and other tax records, as applicable; Copies of Contracts or Agreements (whether customer or supplier), if applicable; and Credit insurance (as required and if applicable).

Audit Confirmations

On matters relating to Exchange confirming third-party audited figures, this is not a service that the Exchange provides. TD&T will not confirm any third-party audit figures unless the Originator’s entire account is fully reconciled. Statements are provided as is. Independent of any statements or figures provided by the Exchange, in accordance with the Master Agreement sub section 4.4 (viii), all Originators must keep, or cause to be kept, complete and accurate books and records, including without limitation all books and records required to be maintained.

Definitions

“Fees” for account management is charged at EUR 287.50 per hour and administration is charged at EUR 147.50 per hour. In the unlikely event that the time required to adequately manage and/or administer the Originator account exceeds the monthly time allocation, additional fees will be charged at 7.5 minute intervals, or part thereof.

“Application Fee” is a usually 20.00% of the Arrangement Fee. This fee is charged to process a finance application and is non-refundable.

“Commitment Fee” is similar to an Application Fee and if Trade Desk issue an RPA Offer and the recipient rejects the offer for any reason whatsoever, the fee is non-refundable. Trade Desk is free to make whatever requests it deems reasonable and necessary to protect its interests. After receiving an RPA offer, should the Originator refuse to agree to its terms of business, the RPA offer will be rescinded. If there is no financial change to the deal as determined by Credebt®, in its sole discretion, or no misinformation or change to the transaction flow or deal structure or deal schedule has occurred, and the Trade Desk decline to proceed with the RPA Offer, the fee is refunded less any payments due under the Specific Conditions issued with the RPA Offer or any other costs such as time spent by the Credebt® team in preparing the RPA offer, negotiating the terms of the offer or on due diligence. Any refund will also deduct third-party fees, e.g. legal fees, assessment and/or surveyor fees, etc. An accepted RPA Offer with an Arrangement Fee amount specified, may have the Commitment Fee deducted from it. If there is no Arrangement Fee in the RPA Offer, the Commitment Fee will be refunded.

“Allocation Limit” means an Originator agrees not sell ETR with a combined total value that is greater than the value of the Revolving Purchase.

“Revolving Purchase” means the Revolving Purchase value specified in the Revolving ETR Sale Agreement [RSA].

“Over Allocation” means an Originator agrees to sell on a revolving basis ETR at a fixed value with a specific total value, over a fixed period of time and which the Originator does not substantially meet their obligation, or does not exceed a minimum of 75.00 per cent of their obligation on a recurring basis.

“ETR” means the sale and purchase of invoices issued under Contract for the supply of goods and services and such invoices, so offered, are fixed value Exchange Traded Receivables or “ETR”.

“Revolving ETR” means any Eligible ETR, which an Originator agrees to sell on a revolving basis ETR at a fixed Discount Rate with a specific total value and over a fixed period of time and which an Investor agrees to purchase from time to time from such Originator on a revolving basis ETR at the same Discount Percentage in an amount not to exceed, at any time, its Revolving ETR Limit.

“Revolving ETR Purchase Agreement” [RPA] means Credebt® is confirming it will buy all the ETR in the Revolving ETR Sale Agreement [RSA] signed by the Originator confirming the terms of the sale, during the applicable Revolving ETR Period, of Revolving ETR which is the subject of an Offer.

“Traded ETR” means each ETR which has been sold in accordance with the Master Agreement together with all Collections and Related Rights with respect to such ETR.

“Face Value” means, at any time and from time to time, the total amount then outstanding in respect of the ETR inclusive of all charges, taxes, surcharges and delivery charges.

“Purchase Date” means:

(i) for any Eligible ETR that is Existing ETR, the date on the ETR for which Credebt Exchange® receives an Accepted Bid for such Traded ETR in the applicable Offer;

(ii) for any Revolving ETR that is a Future ETR, the date on which the Credebt® issues a Revolving ETR Purchase Notice, provided that, in any such case, the Future ETR has come into existence during the Revolving ETR Period; provided that, in each such case, that the ETR is authenticated by the Document Agent; and provided further that, in each such case, the Purchase Price is paid by the Investor by means of certified electronic transfer with notification from Credebt® of the certified transfer of such Purchase Price from the Account Bank to the Originator (Note:- Purchase Payments made to Credebt Money® accounts may be held in another Credebt Money® account other than the one designated to the specific Originator).

“Purchase Price” means the Face Value of the Traded ETR less the Applicable Discount. Note:- Purchase Payments made to Credebt Money® accounts may be held in another Credebt Money® account other than the one designated to the specific Originator

“Settled” means a Traded ETR that is paid in full by the debtor.

“Expected Date” means the date on which an Originator expects the Settlement Date of a Traded ETR will occur, being no later than the Maximum Maturity Date.

“Settlement Date” means the date on which a Traded ETR is paid in full by the debtor and is a recorded and allocated receipt in the Bank Account as determined by Credebt Exchange®.

“Payment Date” means either the Expected Date or the Settlement Date, whichever is later.

“Reserve” means, in the case of a Managed ETR, or a Performance ETR (including any Revolving ETR that is also a Managed ETR or a Performance ETR), subject to the Discount Percentage applied to the Traded ETR, a reserve amount of the Face Value of a Traded ETR or such other amount as Credebt Exchange® may, from time to time, at its discretion, specify. Refer to the Reserve Policy for more information on how discretion may apply.

“Margin Call” means, a specific value equal to the Fx loss specified on an any specific trade, relative to the currency documented in the RPA Offer used to confirm and open the Originator trading account, that is deducted from and noted on the specific Originator’s Exchange Statement where the Fx loss occurred.

“Maximum Maturity Date” means, for any ETR, a maximum number of days from the relevant Purchase Date, as specified by Credebt Exchange®, from time to time. Currently, the maximum number is 180 days.

“Misinformation”, whether supplied in error or by wilful deceit, is the supply of information that conflicts with other information supplied by, or for, the same organisation. For example, if information is supplied that claims to have a signed order and it is discovered during the due diligence phase of evaluating the business that the order is not signed, this is misinformation. Another example would be where the organisation provides information showing turnover of one amount that is subsequently proved to be substantially less during the due diligence phase of evaluating the business. Misinformation is a serious breach of trust. If misinformation occurs, Credebtt® will issue a Misinformation Notice.

“Misinformation Date” means the date that a letter or email with the title Misinformation Notice is issued by Credebt®.

“Misinformation Notice” means a letter or email issued by Credebt® stating that misinformation has occurred as determined by Credebt®, in its sole discretion. The Misinformation Notice negates all prior agreements, contracts or intent whether in writing or otherwise. Credebt®, in its sole discretion, will determine what costs have been incurred and will seek to have those costs recovered by whatever means. In the interest of good business conduct, if Credebt® can resolve any matter related to the misinformation, it will do so on the understanding that any product or proceed created post the Misinformation Date is an entirely new transaction with no connection to agreements, contracts or intent prior to the Misinformation Date.

“Eligible ETR” means (a) with respect to any Future ETR, any ETR upon becoming existent, or (b) any Existing ETR, in both cases complying with any and all eligibility criteria set forth in Section 6.8.2 of the Master Agreement, as follows:

(i) the terms of such ETR submitted to the Exchange are true and correct and have been confirmed by the Originator through the Exchange by means of a posting by the Originator on, or other computer transmission sent by the Originator to, the Exchange, which shall in each case shall include the following information: Face Value, payment terms, debtor name, Expected Date and any other information required by the Exchange system when trading over the Exchange;

(ii) (a) by its terms is due and payable by the debtor on or prior to the Maximum Maturity Date and (b) has not been compromised, adjusted or modified (including by the extension of time for payment or the granting of any discounts, allowances, credits or Dilution), except as reflected in the Face Amount thereof;

(iii) arises under a Contract that, together with such ETR, is in full force and effect and constitutes the legal, valid and binding obligation of the debtor enforceable against the debtor in accordance with its terms, and is not subject to any Dispute;

(iv) all goods and services represented by the ETR have been fully delivered and performed (except post-delivery obligations including, without limitation, warranties) and at any time prior to the Settlement Date, the debtor does not deny any or all money owing in respect of the ETR;

(v) arises under a Contract that permits assignment or does not require the debtor to consent to the transfer, sale or assignment of the rights and duties of the Originator under such Contract;

vi) arises under a Contract (a) that contains an obligation to pay a specified sum of money equal to the Face Amount of such ETR, contingent only upon the sale of goods or the provision of services by the Originator, and (b) with respect to which the Originator has performed all obligations required to be performed by it thereunder, including shipment of the goods and/or the performance of the services purchased thereunder;

(vii) arises solely from the sale of goods or the provision of services to the debtor by the Originator in the ordinary course of the Originator’s business, and not by any other Person (in whole or in part);

(viii) together with the Contract related thereto, does not contravene any law, rule or regulation applicable thereto, or any agreement of the Originator;

(ix) is not an ETR (a) as to which any payment, or part thereof, has been made on or after the original due date for such payment, (b) as to which an Insolvency Event occurs with respect to the debtor, or (c) which is identified by the Servicer as uncollectible; and

(x) in respect of each Traded ETR, the debtor has been notified (which notification has not been countermanded) of such purchase made in the form of the Notice of Assignment.

“Rating Agency” means Credebt®, AIG or any other insurance provider as Credebt® may in its sole discretion think fit and any internationally recognised rating agency that provides Ratings relating to the credit history and creditworthiness of corporate or sovereign entities.

“Ratings” means any credit ratings assigned by a Rating Agency in respect of any corporate or sovereign entities from time to time.

“Repurchase Price” means with respect to any Traded ETR to be retransferred pursuant to Section 6.12 of the Credebt® Master Agreement, the Purchase Price of such Traded ETR, plus the daily Discount Percentage for each day that such Traded ETR is outstanding less any applicable fees and/or commissions as Credebt® may, from time to time, at its discretion, specify.